Are you looking for the best startup business loan?

With interest rates in flux, it might be the best time to get a business loan for the foreseeable future.

We’ll share exactly what you need to know about startup business loans. So read on if you’re serious about finding the right loan option for your unique needs!

What Are the Best Startup Business Loans Right Now?

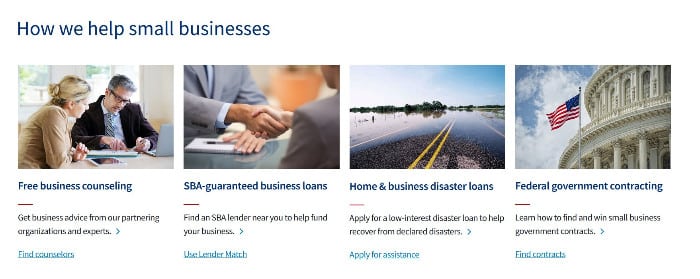

SBA

Small businesses are the backbone of most communities, and those just starting out need resources to make their idea come to fruition.

Fortunately, the U.S. Small Business Administration (SBA) offers one of the best startup business loans.

Why We Picked It

The SBA has a variety of loan programs available to suit different needs, including both long-term and short-term solutions.

Benefits offered by SBA loans include:

- Low interest rates

- Flexible terms

- Minimal requirements such as collateral or excellent credit

Furthermore, SBA loans are typically easier to obtain than traditional bank finance and can provide access to additional capital that may be difficult to source from other sources.

With an SBA loan, entrepreneurs can acquire financing for many endeavors in their business journey.

Loan Amounts

If your business is looking for a loan and you want competitive rates with flexible terms, consider researching the best startup business loans available from the SBA.

- The Small Business Administration provides loan amounts of up to $5 million. This provides invaluable assistance for businesses and entrepreneurs ready to take their operations to the next level.

- Because these loans come from a government-backed institution, businesses and entrepreneurs can count on competitive rates and more flexible terms than other financing forms.

Pros

The Small Business Administration (SBA) has long been a go-to resource for business owners who need financing.

- The SBA provides loan options tailored to accommodate startups, helping those businesses achieve their goals.

- Furthermore, SBA-backed lenders provide more favorable terms than traditional banks, usually offering low interest rates and longer repayment periods. This can help maintain a healthy cash flow for new businesses.

- Potential borrowers are also met with support from knowledgeable staff able to advise them on best practices when selecting and applying for loans.

- Finally, an SBA guarantee enables businesses to borrow much larger amounts than they would typically be able to.

Business owners looking to get a jumpstart on their venture may want to consider starting at the SBA.

Cons

The Small Business Administration (SBA) is an option to receive capital, but it also has a few drawbacks.

- SBA loans require extensive paperwork and an approval process, which can be burdensome for small businesses on a tight budget.

- They also have long wait times for approval, preventing owners from pursuing opportunities in the interim.

- Added to this are the uncertain interest rates and forbearance policies, making it difficult to make informed financial decisions.

While SBA loans may offer an important financial aid solution for some businesses, small business owners should consider certain cons of using SBA.

Lendio

If you’re looking for the best startup business loans, you need to check out Lendio.

This financing platform provides small businesses and entrepreneurs access to fast, flexible funding from over 75 lenders.

Why We Picked It

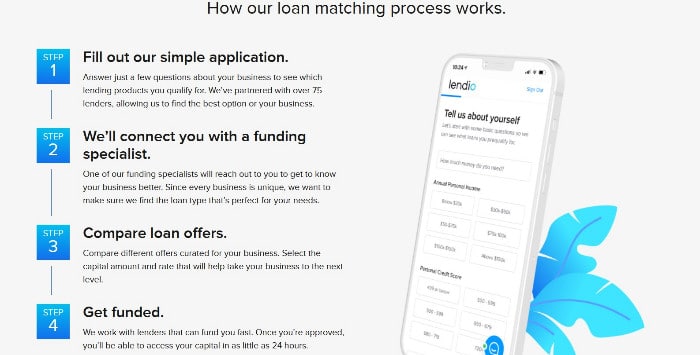

Thanks to the power of the Lendio network plus advanced technology, loan seekers can obtain an array of financing options tailored to meet their needs.

Regardless of background or credit profile, lenders accept all applicants through a convenient, secure process.

With over $12 billion in 10-minute approvals already funded, customers can’t go wrong when they use Lendio’s best startup business loans.

Loan Amounts

Lendio offers some of the best startup business loans available.

- Through this platform, you can secure a loan ranging from as little as $500 all the way up to $750,000 (although large loan amounts will require larger personal incomes).

- Typically, most startup loans range between $9,000 to $20,000.

Lendio makes it easy and simple to obtain the most suitable loan for your needs, allowing financial freedom to kickstart your startup journey.

Pros

With Lendio, these days, it’s easier than ever to get the best startup business loans.

- The application process is incredibly quick, so you don’t have to wait long to find out if you’re approved.

- Plus, they can provide loans even to those with lower credit scores, so that ambitious entrepreneurs with historically shaky credit can still get the funding they need.

- Furthermore, through Lendio, you can access multiple types of loans that best fit your needs.

Whether you need funds for equipment or a working capital loan, Lendio will surely give you the best options.

Cons

While Lendio may be suitable for the best startup business loans, they can have some disadvantages.

- One of the primary disadvantages is the additional documentation required for certain loans.

- Lendio’s terms and conditions can be complex, making it difficult to determine exactly what documents you will be expected to provide to qualify for a loan.

- On top of that, the terms may vary depending on the lender and creditors, creating an extra layer of complexity when considering this option.

Taking care to research your options and understand any necessary documentation will help you make a wise decision when considering startup business loans from Lendio.

Kabbage

Kabbage has quickly become one of the market’s best startup business loan solutions. They have two main products that give business owners plenty of financial options.

- Firstly, Kabbage offers a line of credit that gives businesses access to smaller amounts of money they can draw on at any time.

- They also offer short-term loans for larger expenses, which provide businesses with larger sums of cash upfront to finance higher costs and projects.

With both options being fast and accessible, it’s easy to see why so many entrepreneurs opt for Kabbage when it comes to financing their startups.

Why We Picked It

Kabbage is the best startup business loan available for small business owners with low credit scores but need extra cash.

- Fund amounts range between $2,000 and $250,000, depending on your credit limit approval.

- With Kabbage, you can take out loans up to the approved maximum limit quickly and easily using their mobile app, website, or Kabbage bank card.

Hassle-free borrowing tracking, repayment flexibility, and simple repayment options make this one of the best options for small business owners with limited financial resources.

Loan Amounts

For the best startup business loans, Kabbage is one of the best options available.

- With loan amounts up to $250,000, Kabbage provides an easy-to-manage loan repayment process with maximum funding rates of 10% per month.

- Additionally, third-party partners can add up to 1.5% to the maximum rate offering more flexibility and choice to clients.

- With a six or 12-month loan period, clients will pay back a sixth or twelfth, respectively, of the total loan amount applied for.

One big currency of using this loan partner is that there are no prepayment penalties enabling earlier repayment of the loans and saving money on monthly and origination fees.

Pros

Kabbage is best known for providing the best startup business loans, but its services don’t end there.

The many benefits of using Kabbage include:

- Quick and easy signup process

- Fast funding and easy repayment with no origination fees or prepayment penalty fees associated with the loan

- Payment and invoice solutions, as well as financial advice and analysis to help understand your cash flow.

- An easy-to-use mobile app and online software that lets you manage multiple loans in one place

- Linking to accounts like Paypal, Quickbooks, Amazon, and eBay can be easier managed by a Kabbage account card.

The Smartbox calculator also gives an estimate of the expected fees on loan, so it’s fast and simple to find out whether Kabbage is the best option for your financing needs.

Cons

Kabbage is one of the best startup business loans for small business owners, but there are a few drawbacks worth considering.

Cons of using Kabbage include:

- Short loan terms of only 6, 12, and 18 months are available

- Kabbage is only available in the US. Additionally

- Loans are limited to $250,000, which could be too small for some startups.

Although they offer quick access to capital and are relatively easy to apply for, their limitations could make them a hassle for larger businesses.

BlueVine

Since 2013, BlueVine has become one of the best startup business loans provider owned by founder and CEO Eyal Lifshitz.

- With devotion and hard work, in just 2016, the company was able to secure a total of $40 million in capital and keep increasing it to fund over 25,000 small business owners with a record amount of $3 billion.

- BlueVine is known worldwide as a leader among providers who strive to contribute to the success of entrepreneurs by providing efficient capital services.

- They offer three advantageous loan products – Flex Credit, invoice factoring, and short-term loans – so whatever a customer’s needs may be, BlueVine has the best solution.

Since its inception, BlueVine has constantly amazed with inspiring stories from small business owners on how BlueVine turned their vision into reality.

Why We Picked It

For the best startup business loan options, BlueVine is the best choice.

- Their application process is kept simple, giving entrepreneurs a stress-free way to apply for the funds they need.

- Not only does BlueVine make applying for loans easy and free, but it also has an incredibly fast turnaround time.

- It takes only minutes to complete the online form and get approved for a loan.

- Moreover, they offer a Paycheck Protection Program to accommodate businesses affected by the current COVID-19 outbreak.

With such an effective, speedy way to get financial support, BlueVine has quickly become one of our top choices for the best startup business loans.

Loan Amounts

Business owners can look to the best startup business loans provider, BlueVine, for reliable and flexible financing solutions.

BlueVine offers 3 loan options for those looking for short-term or long-term financing:

- Flex Credit: This program enables users to draw funds as much or as little as they need up to a limit of $250,000 and then replenish it with each repayment.

- Short-term business loans: up to $250,000 with quick approvals in five minutes.

- Invoice Factoring: this option allows business owners to receive cash advances based on their outstanding invoices from clients with credit limits that grow with sales – up to an impressive $5 million.

With these innovative options, BlueVine is one of the best places to turn to startup businesses seeking the funds they need.

Pros

BlueVine is one of the best startup business loans available today.

The pros of using BlueVine are:

- The process is quick and easy, with upfront interest rates and no hidden costs.

- You can do so conveniently when making payments through an automated clearing house (ACH).

- Customer support is also excellent, so any questions you have should be resolved quickly.

With features like these, it’s no wonder that more and more entrepreneurs are turning to BlueVine for their financing needs.

Cons

For best startup business loans, BlueVine is one of the best services in the market; however, it does have a few cons.

The cons of using BlueVine are:

- BlueVine is only available within the United States

- BlueVine services are limited to B2B companies and aren’t best suited for individual consumers or B2C companies.

Although BlueVine still offers competitive rates and quick approval times, other lenders are more suitable for certain businesses that cannot utilize BlueVine’s offerings.

Become.co

Become.co is a best-in-class matchmaking service for startup businesses seeking loans that puts lenders in competition to fund your project.

- Become.co simplifies the lending process by providing a centralized platform to collect information from potential borrowers and then forwarding it to partner lenders – allowing the lenders to decide whether they want to move forward with a financing offer.

- This process eliminates the need for endless applications and communication with multiple lenders, inverting the process so the best offers can find you quickly!

Seem too good to be true? Become.co has been helping startups and small business owners since its emergence in 2014, revolutionizing the best startup business loan world through lender competition.

Why We Picked It

Become.co is one of the best in providing complete and comprehensive lending solutions.

- With their unique technology, they use advanced algorithms that accurately match business borrowers to alternative lenders.

- In addition, their process is free for all users.

- The process creates a proprietary LendingScore™ which profiles each individual business to help them develop financially and access new opportunities.

With such comprehensive services offered by Become.co, businesses can rest assured they will find the best funding options best adapted to their specific needs and goals.

Loan Amounts

Become.co provides unbeatable options for the best startup business loans!

- Available loan amounts range from $5,000 all the way up to $500,000

- Repayment terms vary between 3 to 36 months – allowing you to choose a loan period best suited to your personal business needs.

- Repayments are not dependent on interest rates: You agree on an upfront payback amount based on your business type and loan term.

Pros

Become.co is an excellent resource for startup business loans.

Pros of Become.co:

- Compare quotes from more than 20 lenders.

- You may be eligible for unsecured or secured commercial loans depending on your needs and qualifications.

- The application process is quick and hassle-free, with achievable approval times within 48 hours.

- Flexible loan terms between 3 to 36 months

- A clear understanding of the provided loan terms, so you know exactly what you’re getting into.

- If you are stuck or uncertain about anything related to the best startup business loans, friendly customer service professionals are available via phone support!

With 150 million in successful loans already and hundreds of positive customer reviews affirming its success rate, Become.co is certainly worth your consideration.

Cons

Become.co is a great resource for those seeking the best startup business loans, but there are some cons to using this platform.

Cons of using Become.co:

- Although Become.co is known for connecting borrowers with an extensive network of lenders, it doesn’t provide any funds.

- Additionally, as support staff isn’t available on weekends, borrowers may be unable to answer their questions on time if they become stuck over the weekend.

To get the best out of Become.co, it’s best to have your documents ready and submit questions regarding your loan during regular business hours.

Fundbox

With the best startup business loans, the fintech company Fundbox is the go-to choice for many businesses.

Founded in 2013 and located in San Francisco, Fundbox offers two products that can help grow a business:

- a revolving line of credit divided into invoice financing and a traditional line of credit

- and net terms on business purchases made available by the First Electronic Bank.

Fundbox has been accredited by the Better Business Bureau since 2014, and the great majority of reviews are positive since the program is incredibly helpful to many small businesses.

Whether you’re looking for extra capital or the freedom to purchase items without paying upfront, Fundbox is worth considering.

Why We Picked It

Fundbox offers the best startup business loans, thanks to the two products they offer.

- Their line of credit allows businesses to borrow an amount within the approved limit for 12 weeks or 24 weeks, while the net terms help them make purchases and pay later.

- These products come with no application or origination fees and no prepayment penalties. This makes it easier for businesses to borrow and save on interest if the funds are paid before the scheduled time.

Fundbox even provides discounts in the form of coupons and cashback, which are automatically applied towards the account – making it a great option for small businesses seeking the best startup business loans.

Loan Amounts

Fundbox is the best startup business loan for those who need the money quickly and don’t quite have the collateral or guarantor to ensure the loan.

- With a maximum loan of $100,000, Fundbox offers an achievable amount for businesses of all sizes on easy 12-week /24-week terms with reasonable drawing fees.

- The APR ranges from 10.1% to 79.8%, which is high compared to other lenders, but the flexible loan terms make it the perfect fit for anyone needing a short-term solution to their cash flow needs.

Whether you’re a small business, a startup, or someone needing quick cash flow solutions, Fundbox’s business loans are the right choice!

Pros

Fundbox stands out as a clear leader regarding the best startup business loans.

Pros of using Fundbox:

- Their process is incredibly fast and efficient, so you don’t need to wait around for the funds.

- They have much lower minimum credit score requirements than many other lenders, and the annual revenue and business activity requirements are also moderate.

- They don’t require a guarantor or collateral, and there are no prepayment penalties – whether you have good credit or not, the process can work for you.

With its advantageous conditions, Fundbox can be the perfect lending option for rapidly growing businesses.

Cons

Despite the advantages that Fundbox offers, it is important to understand the cons before getting into a loan agreement.

Cons of using Fundbox:

- The maximum loan amount a borrower can avail through Fundbox is quite low compared to bank loans.

- The interest rates and APR are significantly higher than the rates offered by banks.

- The duration for loan repayment is fixed.

- The application process requires giving Fundbox access to your books and business account, which is secure but an uncomfortable step for many applicants.

Despite these drawbacks, it still tends to be the preferred choice for many entrepreneurs because of its features like quick loan disbursal and no need for collateral.

What is a Startup Business Loan?

A startup business loan is a financing specifically tailored for early-stage businesses.

- This type of funding allows businesses to cover the costs associated with the growth and expansion of their company.

- These costs may include everything from the purchase of equipment to the development of new marketing plans.

- Many lenders offer different terms and qualifications for these types of loans, so it’s important to research and find the terms that best fit the needs of your business.

With careful budgeting, the right lender, and a repayment plan, a startup business loan can be the perfect solution to take a business to the next level.

What You’ll Need to Qualify for a Business Loan?

Credit Score

A business loan can be the right solution for the budding entrepreneur, especially the best startup business loans. But the question is: what do you need to qualify?

First and foremost, having a solid credit score is the most important part of the equation. Most lenders will require the borrower to have a solid credit score, typically hovering around the mid-to-high 700s range, to be approved.

A good credit score will:

- Demonstrate your ability to responsibly handle debt, giving lenders an indication that you are the type of borrower who will pay the loan on time.

- Provide you access to lower rates and better terms, so it’s important to ensure that all your past debts have been properly managed before you seek a business loan.

Making sure your credit score is up to date before submitting the loan application is essential to increase your chances of being accepted and potentially obtaining more favorable terms.

Personal Income Statements

One of the most important qualifications lenders will be looking for is an up-to-date personal income statement.

Your personal income statement will:

- Provide your lender with proof of money coming into your business that they need to feel secure in giving you the loan.

- Show your past profits and losses so lenders can make the best decision when deciding whether or not they will give you the loan.

- Show you have awareness and understanding of your finances, which can bolster the trustworthiness you need to gain access to the money you require to succeed in your business endeavor.

These documents can give the lender the confidence they need to grant the loan.

Preparing these documents before the application can make the process smoother and lead to a successful outcome.

Business Tax Returns

Another crucial item you will need to provide when applying for a loan is your business tax returns.

- Your returns are the most judged documents when viewing a loan application.

- They allow lenders to review your company’s financial health before approving any loan requests.

- Providing accurate and up-to-date business tax returns will increase your chances of securing the loan and decrease the time it takes to process the application.

Prepare your tax returns with care and confidence to maximize the financial contribution that startup loans can bring!

Business Plan for Your Startup

To qualify for the loan, it’s essential to show a detailed business plan that details your startup’s exact goals and objectives and how you will reach them.

Investors or loan officers will analyze the plan to ensure the soundness of the business’s strategy.

Your business plan should include the following:

- an accurate description of the company

- a market assessment with potential audiences

- a financial analysis that includes a realistic budget from expected revenue and expenses

- marketing strategies with careful attention to competitors

- and the qualifications of the management team that support the goals of the startup business.

This plan will help the loan provider understand your overall financial outlook and capacity to pay back the amount borrowed within the agreed timeframe.

Knowing what’s needed to qualify for a business loan before you apply can save time in both the short and long term.

Legal Entity Documents

As part of the application process, businesses will need to provide legal documents proving the organization’s existence.

These documents may include the following:

- Articles of Incorporation if the business is incorporated

- Certificate of Organization if the business is registered as an LLC.

- A valid Employer Identification Number (EIN) – issued by the Internal Revenue Service.

Obtaining the necessary documents and having a well-prepared loan request increases any business’s chances of getting accepted into the best startup business loans available today.

All Banking Information

To secure the necessary funds to get your business off the ground, you must provide prospective lending institutions with all banking information.

This can include:

- bank account numbers

- routing numbers

- all PIN’s on hand

- information regarding existing debts

- balances on existing and past loans

- balance sheets

- cash flows

- and profit and loss report to prove the sustainability of your business model.

Gathering all this information can be daunting, but it is essential if you want the best startup business loans available.

How to Compare Business Loans

Know the Requirements

Comparing the best loans for your startup business is the key to finding the right fit.

To start the comparison process, take a close look at the requirements of each loan.

While the type and amount of the loan will vary by the lending entity, you’ll want to be sure that the criteria matches up with the needs of your specific business.

Questions you may want to consider include:

- Does the lender require a personal guarantee?

- Are there restrictions on the type of use that the funds can be put towards?

- Are there prepayment penalties if you can repay the loan more quickly than expected?

Taking all these into account when making your assessment, you should have no trouble finding the right fit among lenders who offer the best startup business loans.

Know How You’ll Get Your Funds (And When)

Before selecting the best startup business loan for your business, make sure you know the available options closely and the method by which you will receive the money.

Depending on the loan product you choose, the timing and the frequency of the payments can vary greatly.

- Some loan products may require a single payout upfront, with all the money made available immediately

- others may provide smaller installment payments throughout the loan period.

Knowing the details of your repayment structure and understanding associated costs ensures that you make an informed decision when selecting the best business loan option for your needs.

Know the Repayment Terms

With the current economic upheaval and the need for new or existing companies to seek the best startup business loans, it is important to know the exact repayment terms of the loan.

A comparative analysis of the different loans available from lenders will help you make the best decision.

Make the most informed decision by examining the:

- rate of interest

- tenure

- prepayment penalty

- mode of payment

- and late payments penalty

Knowing the repayment terms in advance would allow you to adequately prepare for your financial obligation in the future.

Know the Interest Rates

Knowing the interest rates various lenders offer is essential to finding the right loan.

- Different lenders have different terms, rules, and regulations; understanding the differences can help you make the best choice for your business.

- Research the interest rate range of the best startup business loans and opt for the one that offers the lowest possible rate.

This research can help reduce the cost of borrowing so you can put more money back in your pocket.

Know the Additional Fees

When it comes to the best startup business loans, one must pay attention to their additional fees.

There are many types of additional fees to take into consideration before signing a contract, including:

- interest

- prepayment penalties

- late payments charges

- document preparation costs

- other administrative costs

Considering the long-term impact of a loan and understanding all associated costs will certainly lead to the best decision for any aspiring entrepreneur.

Types of Startup Loans

Deciding on the best startup business loans to pursue can be a difficult step for the aspiring entrepreneur.

Many small business owners are unaware of the range of options available to them, particularly the newer and lesser-known forms of loans, such as crowdfunding or embedded lending.

By researching the best loan types for your unique business and understanding the associated costs, you can make a more informed decision and find the best startup business loan to best suit your needs.

SBA Loans

For the best startup business loans, the Small Business Administration (SBA) offers one of the most advantageous loans.

- Typically, the SBA works with banks to give business owners the funds they need while reducing overall risk.

- SBA loans are government-backed, making them a popular choice for businesses that may not have the best credit rating or the collateral needed for other types of loans.

- They come with lower interest rates and longer terms than many private loans, allowing the borrower to spread the costs out in manageable payments until the loan is paid in full.

With fixed rates and flexible repayment schedules, an SBA loan could be the perfect option to help you jumpstart your business without putting too much pressure on your budget.

Asset-Based Loans

One type of the best startup business loans is asset-based loans, which are funds the lender advances based on the value the borrower can use as collateral.

- Asset-based loans usually require high amounts of cash relative to the debt the borrower is requesting.

- An asset-based loan provides an advantage because the debt can often be repaid over time at much lower interest rates than traditional term loans or lines of credit.

- Asset-based loans provide flexible repayment instead of fixed costs, making them particularly attractive for new businesses with unknown cash flow projections.

This type of loan option benefits those with the resources to provide secure financials in return for the lender’s assurance of a safe investment.

Online Term Loans

Online term loans provide a way to quickly have the necessary capital on hand, with the flexibility of different interest rates and repayment terms.

- With these loans, borrowers can apply for the funds they need within minutes and get the money transferred to their account in as little as one business day.

- Online term loans also offer borrowers the convenience of accessing the loan from anywhere at any time and making payments through automated withdrawals from the bank account.

- This type of loan helps entrepreneurs with their immediate financing needs. It also helps them with their long-term goals by providing more flexible payment terms and lower interest rates than traditional lenders.

An online term loan’s flexibility and repayment structure makes it one of the best options for any new business venture.

Personal Loans

A personal loan is often the go-to option when searching for the best startup business loans.

- This type of loan requires the borrower to be the primary applicant. It typically comes with no limitations on using the funds – making it an ideal solution for startups that need funding to cover the upfront costs such as supplies, payroll, and more.

- Additionally, personal loans offer the advantage of having fixed monthly repayments, making it easier to plan finances in the long run.

This flexibility offers budding entrepreneurs peace of mind as it allows them to craft a financial repayment plan that works best for them.

Business Credit Cards

The business credit card is one of the most popular and effective financing options.

- Business credit cards can offer the flexibility needed for startups, allowing owners to spend as needed and keep cash flow moving.

- They typically come with special discounts and rewards that benefit new businesses, as well as customizable payment plans that accommodate the unique needs of startups.

Considering the advantages of a business credit card should be a top priority for those looking to start a company.

Small Business (Startup) Grants

One of the best startup business loans is small business grants which involve the government providing the funds without the need for repayment.

- The requirements for these types of loans depend on the country they come from and the activity the business wants to engage in.

- However, most grants come with specific conditions regarding how the money must be used within a particular timescale or overall budget, making them a very targeted form of loan for those ready to put in the time and effort needed for success.

For entrepreneurs looking for the best startup loans, understanding the different options and finding the one that fits their specific needs is essential in getting the unique guidance needed to start a successful business venture.

Wrap Up

Choosing the best startup business loans can be a daunting task. There are many options available, but understanding each loan and the conditions that come with it is key to making sure you get the best financing option for your business.

Consider online term loans, personal loans, business credit cards, and small business grants to find an option that best fits your needs and helps you succeed.

We’d love to hear your thoughts! What loan best fits your business? Let us know in the comments section below.

Happy financing!

Business Startup Loans FAQ

The best loan for a startup business depends on the individual circumstances of the business. Term loans, personal loans, business credit cards, and small business grants are all viable options when looking for startup funding. It’s best to evaluate your needs and the type of financing best suited for your venture and then make an informed decision about which loan best fits your needs.

The credit score required for a start-up business loan varies depending on the lender and type of loan. Generally, banks and other traditional lenders require strong personal credit scores to qualify for a loan. Still, some alternative lenders specialize in offering loans to those with less-than-perfect credit.

The amount of money you can get for a startup business loan depends on the lender and the type of loan. Generally, most lenders will provide up to $50,000 in financing for those with good credit. However, some lenders may be able to offer more depending on your individual circumstances.

Yes, you can get a loan if you just started a business. Some lenders specialize in offering loans to those with less-than-perfect credit and may be willing to work with startups. However, it’s best to evaluate your specific financial situation and ensure that the loan suits your needs before taking out any type of loan.

Loans can be a great option for startups, as they provide access to capital that typically isn’t available to new businesses. However, it’s best to evaluate the specific loan and ensure that it fits your needs before taking out any type. It’s important to ensure you can repay the loan on time, as late payments could negatively affect your credit score.

Getting a startup business loan can be difficult, as banks and other traditional lenders typically require strong personal credit scores. However, some alternative lenders specialize in offering loans to those with less-than-perfect credit. It’s best to research and shop for the best rates before taking out a loan.

The post Best Startup Business Loans (2023) appeared first on Tweak Your Biz.

0 Commentaires