Estimated reading time: 10 minutes

Today’s reader note deals with an important subject – compensation. Both employees and employers need to know the principles of compensation so they can understand if they’re being paid correctly and equitably.

My husband and I accepted jobs with a Christian non-profit as houseparents for foster kids. The kids go to regular public school. We are required to live on premises and not allowed to work another job. We each make a salary of $446 weekly.

It was our understanding that we would be classified as salary, but nonexempt, with a 40-hour workweek. In practice, we’re treated as if we are salary exempt and have consistently worked over 40 hours weekly without further compensation. I thought salaried exempt had a minimum weekly wage of $684.

I’m hoping you can sort this out for me. If we are salary exempt, shouldn’t we each be making $684 weekly? Thank you so much for any help.

There are so many things we don’t know about this situation like where the individuals are located, what their job offer said, etc. But I thought this would be a great time for a refresher on the Fair Labor Standards Act (FLSA) which is the law that deals with exempt and nonexempt classifications.

To help us understand more, I reached out to my friend and employment law attorney Carrie Cherveny to see if she would assist, and thankfully, she said “yes”. Carrie is senior vice president of strategic client solutions in HUB International’s risk services division. In her role, she works with clients to develop strategies that ensure compliance and risk mitigation when it comes to insurances such as health and welfare programs and employment practices liability.

Please don’t forget that Carrie’s comments shouldn’t be construed as legal advice or as pertaining to any specific factual situations. If you have detailed FLSA questions, they should be addressed directly with your friendly neighborhood labor and employment attorney.

Carrie, thanks so much for being here. Let’s start with a definition. I think many people know what salaried (exempt) and hourly (nonexempt) mean. What’s “salaried nonexempt”?

[Cherveny] As you mentioned, when we talk about the rules that govern employee pay and classifications, we are talking about the Fair Labor Standards Act (FLSA). Some states may have their own equivalent which may be as strict or stricter than the federal. The FLSA establishes the non-exempt employee minimum wage, overtime, recordkeeping, and child employment standards.

A ‘salaried’ nonexempt employee is somewhat of a misnomer – while the DOL does recognize such a classification – it does not change the employee’s classification as non-exempt nor the overtime obligations. More accurately, it refers to payroll practice rather than an actual legal classification of an employee. Like you said, we all know and understand that nonexempt employees must be paid for all hours worked and must be paid at least the federal overtime rate for all hours worked in excess of 40 hours in the workweek (state laws may vary). Sometimes, an employer provides a nonexempt employee with a structured 40-hour workweek. In that case, the employer may set up a recurring payroll each week for the nonexempt employee.

However, even when the employer pays the employee a set 40-hour workweek, the employer remains obligated to capture accurate time records for each of its nonexempt employees, for at least two reasons:

- it is their statutory obligation and in the event of litigation, without those records the court will rely on the employee’s version of the facts and hours worked; and,

- the timekeeping records are necessary to be sure that the employee is paid properly for any overtime hours worked.

Consequently, I have always recommended that employers avoid this payroll approach and pay their nonexempt employees based on actual hours worked and the employee’s timekeeping records.

How would an individual find out how they are classified? Can employers change an employee’s classification without notifying them?

[Cherveny] Often, an employee’s status may be indicated on the employee’s paystub. Otherwise, the employee may ask human resources or payroll about their FLSA classification.

FLSA employee classifications are a story of substance over form. Meaning, the employees’ FLSA classification is determined by the nature of the work performed. Essentially, the FLSA default classification is nonexempt. All employees should be treated as nonexempt and subject to the minimum wage and overtime rules unless the employee’s position qualifies for an ‘exemption’. The Department of Labor (DOL) provides significant guidance and fact sheets to help employers determine if an employee’s position is eligible for an exemption. There are a number of exemptions to the minimum wage and overtime rules, but each comes with its own set of complex criteria and requirements.

Speaking of exemptions, in the FLSA, I’m aware of the ones for executive, administrative, professional, computer, and outside sales. Are there exemptions for non-profits? Or for individuals who work as houseparents?

[Cherveny] There are two ways that employees and/or employers become subject to the FLSA.

The first test is called the Enterprise Coverage Test. Employers that meet the following criteria satisfy the Enterprise Coverage Test and are subject to the FLSA:

- Organizations that have an annual dollar volume of sales or business done of at least $500,000

- Hospitals, businesses providing medical or nursing care for residents, schools and preschools, and government agencies

However, when the Enterprise Coverage Test does not apply, employees may still be individually protected by the FLSA if their position satisfies the Individual Coverage Test. Employees are protected by the FLSA if their work regularly involves them in interstate commerce (commerce between states). The FLSA covers individual workers who are ‘engaged in commerce or in the production of goods for commerce’.

The DOL provides examples of duties involved in interstate commerce such as:

- produce goods (such as a worker assembling components in a factory or a secretary typing letters in an office) that will be sent out of state

- regularly make telephone calls to persons located in other states

- handle records of interstate transactions

- travel to other states on their jobs

- do janitorial work in buildings where goods are produced for shipment outside the state

FLSA and Non-Profits – While subject to the same Enterprise Test, it applies a bit differently to non-profits. Because the FLSA generally applies to businesses with annual gross volume of sales made or business done of at least $500,000, non-profit charitable organizations are generally not covered enterprises under the FLSA. However, the non-profit may be subject to the FLSA under the Enterprise Test if it engages in commercial activities that result in sales made or business done, such as operating a gift shop or providing veterinary services for a fee.

Income generated by charitable donations and membership fees are generally not included in the annual revenue calculation. The FLSA exception for non-profits is a complicated one and non-profit organizations should work closely with outside counsel to determine if they are subject to the FLSA. The DOL provides the following illustration:

A non-profit animal shelter provides free veterinary care, adoption services, and shelter for homeless animals (charitable activities). In addition, the shelter provides veterinary care for a fee to customers (commercial activities). If the revenue generated from the organization’s commercial activities is at least $500,000 in a year, the employees engaged in the commercial activities are protected by the FLSA on an enterprise basis. Employees of the organization’s charitable activities are not covered on an enterprise basis since those activities do not have a business purpose.

FLSA and Domestic Service Workers – The DOL is clear that domestic service workers (such as housekeepers, full-time babysitters, and cooks) are normally covered by the FLSA.

If an employee thinks that they aren’t being paid properly, what’s a good first step?

[Cherveny] The DOL provides employees with vast tools and resources to ensure that they are being paid properly. When an employee visits the DOL FLSA pages, they will be greeted by a pop-up inviting them to download the DOL app that will help them track their hours and overtime compensation.

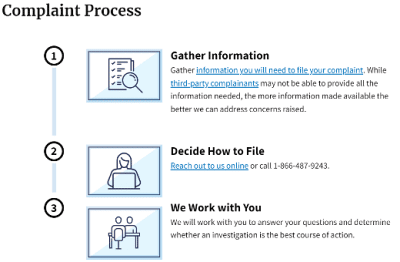

The timesheet app allows both employees and employers to keep accurate records of hours at work including regular work hours, break time, and overtime. In the event of a violation, the DOL provides easy access to make a complaint.

The “Worker Rights” page is filled with user-friendly information regarding an employee’s rights along with information regarding “how to file a complaint”. Additionally, the very easy to navigate complaint page provides clear instructions for each step of the complaint process.

Importantly, the DOL also provides information to workers about their rights in the event an employer retaliates against the employee for making a complaint, either internally or with the DOL.

Last question. I don’t know if we have the whole story here. So, it would be unfair to say that there’s something amiss. The FLSA has been updated in recent years. That being said, an investigation and/or audit should hopefully get to the bottom of the matter. If an organization discovers that they’re not paying an employee properly, what’s a good first step?

[Cherveny] Working closely with outside employment law counsel that specializes in the FLSA is imperative any time an employer has concerns regarding compliance with the FLSA. The FLSA is one of the more complex employment regulations and unlike many other regulations, it can be very counter-intuitive. Working with counsel accomplishes at least two things right out of the gate:

- Privilege for records, documents, and conversations; and,

- Expert guidance for compliance and remedies.

FLSA is tricky and includes a variety of complex exemptions, pay rules, and nuances. An ounce of prevention is just one component of a successful compliance program. Working with or through counsel to audit employee classifications, pay structure, bonus, and overtime calculations is a good place to start. Often, attorneys will partner with an HR consultant to perform the audit – so long as the audit is at the direction and through counsel there may be a chance to protect the audit process, papers, and findings as privileged.

Auditing employee classifications begins with the job description. I often recommend that the employer begin an audit by distributing the job descriptions to the employees performing the job and getting their comments and feedback. Employers are often surprised by the work employees describe versus the existing job description. Engaging the employee in the job description review accomplishes at least two things (1) it makes it harder for the employee to later claim misclassification later; and (2) it helps ensure that employees are doing the job that they are expected to do. Determining the actual classification of the position should include a review by your FLSA counsel to ensure that the classification is consistent with precedent and DOL rules. Counsel should also review pay practices including (among other things) the calculation of overtime for bonused and commissioned non-exempt employees along with pay deductions of exempt employees.

In the event an employer has not been in compliance with the FLSA, simply correcting the employee’s pay does not protect the employer from legal action. FLSA settlement and releases, unlike other regulations, require either DOL or court approval to be enforceable and generally may not be confidential. This means that an employer may ‘settle’ with an employee and still face litigation for the same issue. Therefore, any remedies and corrective measures should be coordinated through the advice and counsel of an experienced attorney.

A huge thanks to Carrie for sharing her knowledge with us. If you want to stay current on mitigating risk in your organization, check out the HUB International Insights blog.

Employees want to know that they are being paid properly. Frankly, organizations should want to know that as well. There’s a huge risk involved with non-compliance. Not only do companies want to establish equitable pay practices but they need to consider how they will regularly monitor employee compensation to ensure it stays that way.

Image captured by Sharlyn Lauby while exploring the streets of San Francisco, CA

The post Why Employees Need to Understand Compensation – Ask HR Bartender appeared first on hr bartender.

0 Commentaires